The Five Major Assumptions Of Linear Regression

- Home

- Forex Trading

- The Five Major Assumptions Of Linear Regression

Contents

Therefore once we have made the assumption about the true error variance what we are left with is to apply the method of weighted least square. The classical linear regression model is one of the most efficient estimators when all the assumptions hold. The best aspect of this concept is that the efficiency increases as the sample size increases to infinity. To understand the concept in a more practical way, you should take a look at the linear regression interview questions. We have seen the concept of linear regressions and the assumptions of linear regression one has to make to determine the value of the dependent variable.

You define a statistical relationship when there is no such formula to determine the relationship between two variables. For example, there is no formula to compare the height and weight of a person. However, you can draw a linear regression attempting to connect these two variables. If you fit a linear regression model to a data which is non-linear, it will lead to Heteroscedasticity. When this condition is violated, it means there is Heteroscedasticity in the model.

Presence of Heteroscedasticity makes the coefficients less precise and hence the correct coefficients are further away from the population value. However, if we fit the wrong model and then observe a pattern in the residuals then it is a case of Impure Heteroscedasticity. Depending on the type of Heteroscedasticity the measures need to be taken to overcome it.

The Breusch-PaganTest is the ideal one to determine homoscedasticity. The Goldfield-Quandt Test is useful for deciding heteroscedasticity. Similarly, there could be students with lesser scores in spite of sleeping for lesser time.

Assumptions

Making assumptions of linear regression is necessary for statistics. If these assumptions hold right, you get the best possible estimates. https://1investing.in/ In statistics, the estimators producing the most unbiased estimates having the smallest of variances are termed as efficient.

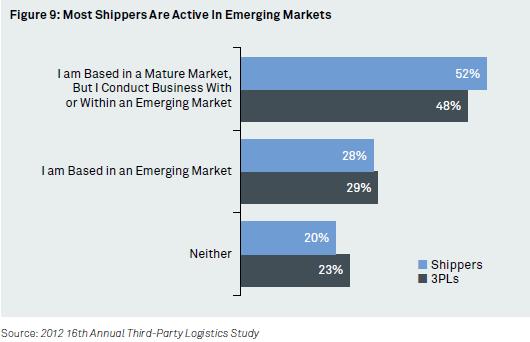

The graph in the below image has Carpet Area in the X-axis and Price in the Y-axis. One of the assumptions of the classical linear regression mannequin is that there isn’t a heteroscedasticity. Specifically, heteroscedasticity is a systematic change in the spread of the residuals over the range of measured values.

This result is a consequence of an extremely important result in statistics, known as the central limit theorem. Many statistical programs provide an option of strong standard errors to correct this bias. Weighted least squares regression additionally addresses this concern however requires a number of further assumptions.

It gives us the p-value and then the p-value is compared to the significance value(α) which is 0.05. If the p-value is greater than the significance value then consider that the failure to reject the null hypothesis i.e. Regression is Linear, if it is greater then reject the null hypothesis i.e Regression is not linear.

Beginner’s Guide to Statistics in Machine Learning and SciPy

When the residuals are dependent on each other, there is autocorrelation. This factor is visible in the case of stock prices when the price of a stock is not independent of its previous one. No or low autocorrelation is the second assumption in assumptions of linear regression. The linear regression analysis requires that there is little or no autocorrelation in the data.

Several modifications of the White method of computing heteroscedasticity-consistent commonplace errors have been proposed as corrections with superior finite sample properties. F Test for heteroskedasticity underneath the idea that the errors are impartial and identically distributed (i.i.d.). If the calculated chi square value is greater than the critical chi square value at (1%,5% or 10% los)the result confirms presence of Hetroscedasticity. 4 Detection of Hetroscedasticity by observing the type of data or the residuals. We have seen that weight and height do not have a deterministic relationship such as between Centigrade and Fahrenheit.

In this lesson we have learn about the concept of Hetroscedasticity i when the error variance varies from observation to observation. We have further looked into different formal and informal ways of detecting the problem by observing the squared residuals or conducting formal tests such as park test, Glejser test,BP test,white test etc. If we know the true error variance then we can transform the model with weights equal to reciprocal of the error standard deviation and Apply OLS to transform model.

Example on Hetroscedasticity

A null hypothesis is where the error variances are all equal , whereas the alternative hypothesis states that the error variances are a multiplicative function of one or more variables . If heteroscedasticity is present in the data, the variance differs across the values of the explanatory variables and violates the assumption. It is therefore imperative to test for heteroscedasticity and apply corrective measures if it is present. Various tests help detect heteroscedasticities such as the Breusch-Pagan test and the White test. Here are some cases of assumptions of linear regression in situations that you experience in real life. Now, that you know what constitutes a linear regression, we shall go into the assumptions of linear regression.

- There is a linear relationship between the independent variable and the dependent variable .

- If we know the true error variance then we can transform the model with weights equal to reciprocal of the error standard deviation and Apply OLS to transform model.

- Biased commonplace errors result in biased inference, so outcomes of hypothesis checks are presumably mistaken.

- In such a scenario, it is better to drop one of many three unbiased variables from the linear regression mannequin.

When correct weights are used, Heteroscedasticity is replaced by Homoscedasticity. Consider we have two variables – Carpet area of the house and price of the house.

Observations of the Error Term should also have No Relation with each other

Linear regression is a straight line that attempts to predict any relationship between two points. However, the prediction should be more on a statistical relationship and not a deterministic one. If the two variables under consideration are x and y, the correlation coefficient can be determined using the formula.

Machine Learning Projects in Python

In other words, by overinflating the standard errors, multicollinearity makes some variables statistically insignificant when they should be important. No or low Multicollinearity is the fifth assumption in assumptions of linear regression. It refers to a situation where a number of independent variables in a multiple regression model are closely correlated to one another. Multicollinearity generally occurs when there are high correlations between two or more predictor variables. In other words, one predictor variable can be used to predict the other. This creates redundant information, skewing the results in a regression model.

Heteroscedasticity is a problem because ordinary least squares regression assumes that all residuals are drawn from a population that has a constant variance . The basic point for the remedial process that we undertake for correcting this problem is to make some transformation so as to make the error variance homoscedastic. One of the advantages of the concept of assumptions of linear regression is that it helps you to make reasonable predictions. When you increase the number of variables by including the number of hours slept and engaged in social media, you have multiple variables. It explains the concept of assumptions of multiple linear regression. The concept of simple linear regression should be clear to understand the assumptions of simple linear regression.

Considering the same example as above, let’s say that for houses with lesser carpet area the errors or residuals or very small. And as the carpet area increases, the variance in the predictions increase which results in increasing value of error or residual terms. When we plot the values again we see the typical Cone curve which strongly indicates the presence of Heteroscedsticity in the model. This consists of taking the data factors of dependent and impartial variables and discovering the line of best match, often from a regression model.

Test for heteroskedasticity underneath the idea that the errors are independent and identically distributed (i.i.d.). Since individuals learn from their mistakes one can expect that the error will fall with practicing and learning over time or with increase in efficiency of say data collection and tabulation. Hence error variance will also change accordingly which confirms hetroscedasticity. The Breusch-Pagan test helps to check the null hypothesis versus the alternative hypothesis.

Rather, when the assumption is violated, applying the right fixes and then operating the linear regression model should be the best way out for a dependable econometric test. Assumption of No Multicollinearity – You can check for multicollinearity by making a correlation matrix (though there are different complex methods of checking them like Variance the error term is said to be homoscedastic if Inflation Factor, etc.). R-Squared only works as supposed in a easy linear regression model with one explanatory variable. With a multiple regression made up of a number of unbiased variables, the R-Squared should be adjusted. The adjusted R-squared compares the descriptive power of regression models that include diverse numbers of predictors.